New technologies are reshaping manufacturing, with AI systems improving efficiency, cutting waste, and boosting reliability. As the industry continues to evolve, leading companies are adopting these innovations to stay competitive.

Industry leaders pioneering these changes face complex B2B sales cycles and need a clear strategy to build strong relationships with the right prospects. However, many companies waste valuable time and resources on poor targeting. In niche markets, a one-size-fits-all approach simply doesn’t work.

Manufacturers operate in specialized markets with fewer decision-makers and longer sales cycles. Without a clear lead qualification process, marketing can lose focus. To improve results, prioritize high-value prospects, tailor solutions to their needs, and guide them through a structured sales process. This approach eliminates distractions, targets the right opportunities, and delivers results.

This guide outlines proven lead generation and marketing strategies tailored for smart manufacturing companies:

Key Lead Generation Challenges in Advanced Manufacturing

1. Long Sales Cycles & Technical Decision-Making

While lead generation is critical for manufacturing businesses, it doesn’t come easy. Long sales cycles, complex buying committees, and a heavy reliance on word-of-mouth can leave pipelines either stagnant or filled with unqualified leads.

Not getting enough qualified leads for your manufacturing solutions?

What do you want to learn?

The Challenge: Lengthy Sales Cycles

Manufacturing sales are inherently complex due to the involvement of high-value products and multiple decision-makers. This complexity, combined with long sales cycles, increases the risk of delays, lost interest, and prospects opting for competitors.

For instance, companies like Intel and AMD serve enterprise clients that require extensive technical validation before making a purchase. Similarly, medical device manufacturers such as Medtronic and Edwards Lifesciences face stringent regulatory and compliance standards, which can further extend the buyer journey.

Without a clear and consistent approach to engaging potential buyers, many prospects may disengage or fail to recognize the full value of the solutions offered. As a result, manufacturing businesses often struggle to maintain a steady flow of qualified leads and conversions.

2. Reaching the Right Decision-Makers

Manufacturing sales don’t hinge on a single decision-maker. Instead, they involve a buying committee with diverse priorities, making it difficult to build consensus and move deals forward. Opportunities can stall or fall apart without a clear strategy to effectively engage each stakeholder.

The Challenge: Engaging the Buying Committee

Manufacturing deals are complex and often involve multiple stakeholders, each with distinct priorities. Engineers focus on performance and technical specifications, procurement officers prioritize cost and supplier reliability, and finance teams require clear ROI justification. Without targeted messaging that addresses each stakeholder’s concerns, deals can stall or even fall apart.

Misalignment between departments complicates the process further, making it hard to secure internal buy-in and move deals forward. Companies like Sesotec, which specializes in quality control solutions, and Rockwell Automation, a leader in industrial automation, must engage engineers, procurement managers, and compliance officers, each with their unique decision-making criteria. Manufacturers risk losing opportunities to competitors who are better at addressing stakeholder concerns with the lack of a clear strategy to align messaging across these diverse groups.

3. Global Competition & Niche Market Positioning

Rising global competition makes it tougher for manufacturers in specialized fields to stand out. Many still depend on referrals and in-person networking—methods that, while effective in the past, no longer provide enough reach.

This limited visibility makes it harder to connect with new prospects and secure long-term opportunities. Without a stronger presence in the market, manufacturers risk losing ground to competitors who invest in broader and more strategic outreach.

The Challenge: Limited Digital Reach

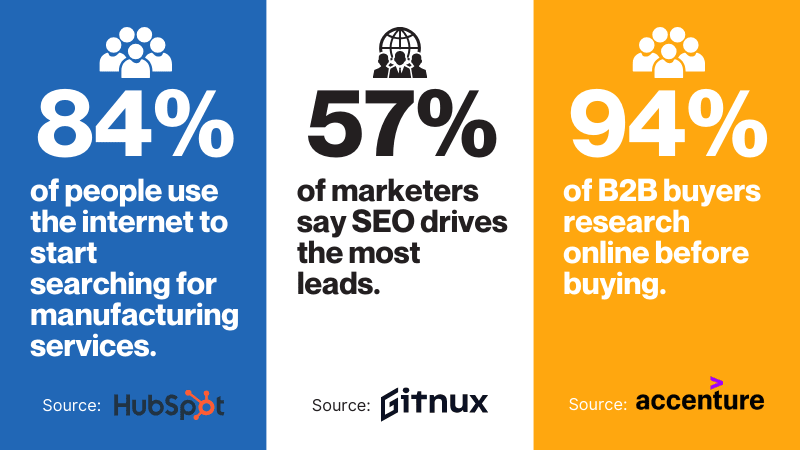

Despite the rise of digital transformation, many manufacturers still underutilize online channels, relying on conventional sales approaches that no longer align with modern buyer behavior. However, research shows that:

- 70% of industrial buyers research online before contacting suppliers.

- 94% of B2B buyers conduct online research before making a purchase decision.

Without a strong online presence, digital manufacturing companies struggle to position themselves effectively in their niche. Companies in sustainable and precision manufacturing—such as Siemens, ABB, and Schneider Electric—need to show credibility and visibility in highly technical fields. Similarly, aerospace and defense manufacturers like Lockheed Martin and Boeing face strict regulatory requirements, making targeted market positioning even more important.

In a market where buyers do their homework long before reaching out, a weak digital presence puts manufacturers at a disadvantage, making it harder to attract demand, nurture prospects, and stay competitive globally.

Best Lead Generation Strategies for Advanced Manufacturing Companies

1. Account-Based Marketing (ABM) for High-Value Clients

Account-based marketing (ABM) reduces nearly 50% of wasted sales time on unproductive leads, giving manufacturers a structured way to engage high-value accounts by focusing on the key decision-makers who influence purchasing decisions.

Unlike broad outreach methods that waste time on unqualified leads, ABM builds Reputation, strengthens Relationships, and increases Revenue by aligning marketing and sales efforts with each account’s specific needs.

Manufacturers dealing with long sales cycles and complex products benefit from ABM’s precision, as it ensures that messaging speaks directly to the concerns of engineers, procurement teams, and financial decision-makers.

For example, semiconductor companies like AMD and Nvidia target enterprise clients through highly personalized outreach, while medical device firms such as Edwards Lifesciences focus on hospitals and procurement teams to navigate strict compliance and budget considerations.

ABM allows manufacturers to concentrate their marketing efforts on the most valuable accounts, ensuring that time and resources are spent on prospects with the highest potential. By engaging key decision-makers with relevant messaging, businesses can build stronger relationships, shorten sales cycles, and increase revenue.

Discover how Callbox ABM Powers Leading Logistics Firm’s Drive to Lead Generation Success

2. SEO & Content Marketing to Attract High-Intent Prospects

SEO helps manufacturers attract high-quality leads by improving their online presence and making it easier for buyers to find them. With 84% of industry buyers starting their search online and 57% of marketers saying SEO brings in more leads than other methods, a well-planned strategy can give manufacturers a strong advantage. Optimizing website content, product descriptions, and technical pages ensures the right audience discovers their offerings.

Companies like Sesotec (industrial quality control) and Keyence (optical & sensor technologies) use technical SEO, whitepapers, and gated content to connect with engineers and decision-makers. Creating valuable content allows semiconductor and AI manufacturers to rank higher in searches and be more visible to customers looking for industry-specific solutions.

SEO reveals buyer search habits and content engagement, helping manufacturers refine messaging and product positioning. Unlike paid ads, it drives long-term visibility and competitiveness without ongoing high costs.

3. Multichannel Outreach: Telemarketing, Email, LinkedIn, and Performance Ads

Relying only on cold calls and emails can mean missed opportunities. A successful multichannel approach starts with in-depth account research to identify decision-makers and understand their needs.

Personalized outreach boosts response rates—tailored emails see up to 26% higher open rates. Companies with strong omnichannel strategies retain about 89% of customers, while weak omnichannel efforts see retention drop to 33%.

The stats mentioned above prove how a multichannel strategy strengthens brand credibility and speeds up sales. As prospects move between social media, email, search, and direct outreach, consistent messaging builds trust and keeps your brand top-of-mind.

As for the channels, LinkedIn boosts professional credibility, while email provides targeted messaging. Performance ads, on the other hand, ensure continuous visibility. Companies like Medtronic use LinkedIn and email to connect with healthcare buyers, while ABB turns to LinkedIn and PPC to engage procurement leads.

When channels and messaging are aligned, businesses capture attention more quickly, improve customer relationships, and convert prospects into sales.

Related: How to Use LinkedIn Connections for Email Marketing

4. Event & Webinar Lead Generation

Events and webinars help innovative manufacturing companies generate leads and build industry presence. Trade shows, workshops, and demos enable real engagement, fostering trust and credibility while capturing leads for follow-ups.

Webinars offer a cost-effective way to reach more prospects. They allow manufacturers to share insights, showcase products, and highlight trends without location limitations.

Webinars are particularly effective at connecting with decision-makers who might not attend in-person events; in fact, nearly 70% of manufacturing professionals participate in webinars to gain insights and best practices from professionals.

To make the most of these opportunities, manufacturers should promote their events to the right audience, simplify the registration process, and provide valuable content. Ending with a strong call to action encourages attendees to take the next step, whether that means requesting a demo, scheduling a consultation, or signing up for additional resources.

Industry leaders like AMD and Nvidia utilize tech conferences like CES and Computex to connect with enterprise clients. At the same time, medical device manufacturers often host webinars to educate hospitals and regulatory agencies about healthcare innovations. Combining in-person and virtual events in a comprehensive outreach strategy, manufacturers can maintain consistent engagement and support long-term business growth.

Hosting your event soon? Learn how to generate leads with business events

Download the guide for free

5. Data Enrichment & CRM Optimization

As lead and customer data grow, many sales and marketing teams find it difficult to manage and use it effectively. That’s where CRM data enrichment proves valuable. It transforms incomplete or outdated records into reliable, actionable insights, helping businesses sharpen their sales strategies, personalize outreach, and improve customer experience.

Data enrichment isn’t just about adding more information. It’s about improving data quality—verifying accuracy, filling in gaps, and combining internal data like transaction history or feedback with external sources such as industry trends or firmographics. This creates a fuller picture of prospects and customers, leading to better decisions and more focused targeting.

The effectiveness of enrichment depends on the quality of both the data sources and the tools used. Advanced platforms integrating with CRMs can automate this process, streamlining workflows and making it easier for teams to act on insights.

Companies like Schneider Electric, Bosch, and Honeywell already use enriched data to refine their target lists and boost CRM performance. Meanwhile, AI-powered lead scoring is helping sectors like aerospace, semiconductors, and medical devices pinpoint the right buyers faster.

The right tools and data turn enrichment from a back-end task into a powerful growth driver.

Industry-Specific Lead Generation Strategies

1. Biotech & Life Sciences Manufacturing

The Life Sciences industry fuels innovation through research on living organisms, while biotechnology applies this research to develop medicines, enhance agriculture, and create sustainable solutions. Bio manufacturing builds on these innovations by using biological systems to produce food and pharmaceuticals more efficiently by reducing waste, lowering fossil fuel dependence, and improving production speed. Leading companies in this sector include Thermo Fisher, Illumina, Bio-Rad, and CSL Limited.

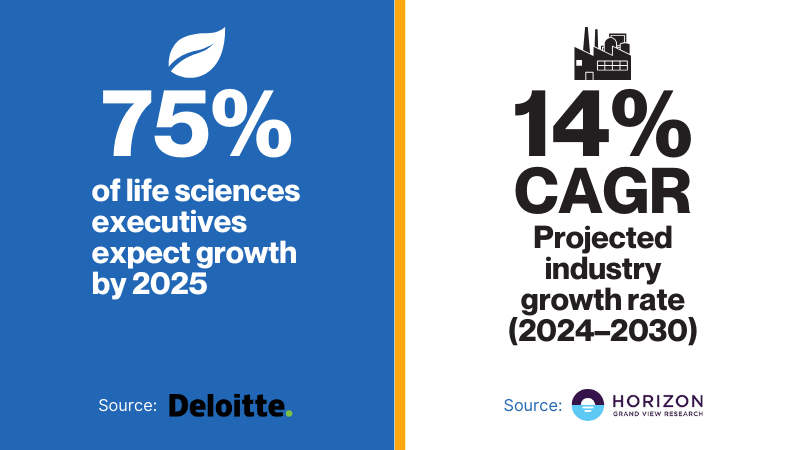

According to studies, 75% of life sciences executives expect growth by 2025, and the industry is projected to grow at a 14% CAGR from 2024 to 2030. These figures reflect growing optimism, driven by scientific breakthroughs, demand for personalized medicine, and advancements in genomics and bioinformatics.

Client Success: Find out how a Healthcare SaaS Vendor’s Pipeline Growth Jumps 2-Fold in a 3-Pronged Campaign with Callbox.

Here are several challenges faced by manufacturers in this sector:

1. Highly Technical Audience

Marketing in this field targets scientists, R&D teams, and procurement professionals. These audiences expect precise, data-backed messaging highlighting real-world application and scientific value. Striking the right balance between technical detail and clear communication is essential.

2. Long Sales Cycles

Biotech products face lengthy approval processes. The path to FDA approval for a new drug can take up to 14 years, involving complex research, clinical trials, and compliance documentation.

The development of new medical treatments follows a long and rigorous process. Basic research typically spans 2 to 5 years, laying the groundwork for discovery. This is followed by 1 to 2 years of preclinical testing to assess safety and biological activity.

Clinical trials, which are conducted in phases to evaluate safety and effectiveness in humans, can take approximately 9 years. Once trials are complete, the FDA review process may take anywhere from 6 months to 2 years. These extended timelines require strategic planning, sustained funding, and a commitment to long-term outcomes.

3. Niche Market with Specialized Buyers

Reaching the right buyers, often a small, specialized group, is another challenge. Engagement requires tailored messaging and deep audience understanding. A drop in private equity’s share of healthcare M&A to 18.1% in 2023 highlights how tight and competitive the market can be.

Lead Generation Strategies

- SEO-Driven Content Marketing

SEO helps more people find your website, which accounts for 53% of total website visits on average. Additionally, 70% of Google users prefer organic search results over paid ads, considering them more credible. A solid SEO strategy builds trust, drives engagement, and keeps your site ranking well over time.

- Account-Based Marketing (ABM) Targeting Pharmaceutical, Biotech, and Academic Research Institutions

ABM is changing how biotech and pharmaceutical manufacturing companies market by zeroing in on high-value accounts with highly personalized campaigns. It connects directly with decision-makers in R&D, procurement, and executive teams, perfect for industries with long sales cycles and layered buying committees. By targeting the right people with the right message, ABM helps build stronger partnerships and stand out in a crowded market.

Global Reach, Real Results: Discover how a medical device provider connected with high-value customers in the US and APAC using Callbox’s Account-Based Marketing strategy.

- LinkedIn & Email Prospecting

LinkedIn and email prospecting are key for reaching R&D decision-makers. LinkedIn hosts 65M+ decision-makers and 10M C-level executives, while 59% of buyers say emails influence purchases, and 80% see email marketing as vital for retention. Leveraging these tools ensures effective outreach.

- Webinars & Virtual Events Featuring Industry Experts

Biotech and life sciences professionals increasingly use virtual events like webinars to update clients on the latest innovations. For instance, Biotech Showcase™ 2025 attracted over 3,000 attendees, including more than 1,020 investors and 340 presenting companies. Events like this offer a powerful platform to connect with industry leaders, share insights, and highlight cutting-edge developments.

2. Semiconductor & AI Manufacturing

AI drives innovation in semiconductor production, helping brands like AMD, Nvidia, Intel, TSMC, and GlobalFoundries detect defects early, predict maintenance needs, and enable real-time adjustments. This technology boosts efficiency and accuracy at every stage, from chip design to testing. In the design phase, AI accelerates simulations, providing insights that human designers may miss.

AI is expected to create up to 95 billion dollars in long-term value for semiconductor companies by driving smarter design, streamlined production, and better performance optimization. This projection reflects the industry’s strong momentum, with global semiconductor sales growing by 19 percent in 2024 to reach 627 billion dollars. East and Southeast Asia continue to dominate the global supply, producing more than 80 percent of the world’s semiconductors and playing a central role in supporting the industry’s expansion.

Below are several challenges that businesses in the semiconductor and AI manufacturing industry must overcome:

- Enterprise Sales with Long Procurement Cycles

The semiconductor supply chain underpins modern electronics, covering design, manufacturing, testing, packaging, and distribution. Producing a semiconductor device can require up to 1,200 process steps over a six- to eight-week cycle, with these steps often spread across multiple locations. This complexity demands extensive coordination and travel between various facilities and companies. - Highly Competitive Market Requiring Differentiation

Differentiation is key to surviving competitive markets. To boost efficiency, 56% of downstream organizations, 85% of industrial equipment firms, and 82% of telecom companies employ custom chips. Moreover, major tech firms are developing proprietary AI chips to reduce reliance on external suppliers, further pushing the industry toward bespoke solutions.

- B2B Buyers Focused on R&D, Performance Metrics, and Supply Chain Reliability

B2B buyers in semiconductor and AI manufacturing prioritize strong R&D capabilities, precise performance metrics, and reliable supply chains. Research from Inbox Insight indicates that 77% of tech buyers consider detailed product performance data crucial in their decision-making. These insights highlight the importance of R&D excellence, accurate performance measurements, and dependable supply chains in meeting buyer expectations.

Lead Generation Strategies:

Semiconductor and AI manufacturers use several tactics to attract and convert prospects:

- SEO & Technical Content Marketing:

Creating high-quality, informative content tailored to engineers, IT buyers, and product developers boosts organic visibility. 76% of marketers report that content marketing effectively generates demand and leads.

- Performance Ads & Retargeting:

Targeted advertising and retargeting capture high-intent searchers, leading to a 3.8% increase in conversion rates. Users exposed to retargeted ads are 70% more likely to convert compared to those who are not.

- Strategic LinkedIn Outreach:

Engaging enterprise-level partners and supply chain stakeholders on LinkedIn is highly effective, with an average message reply rate of 85%—three times higher than traditional email responses.

- Whitepapers & Case Studies:

Publishing whitepapers and case studies that showcase AI-powered semiconductor advancements helps establish authority and attract decision-makers. With 12% of B2B buyers valuing whitepapers and 25% favoring case studies as their preferred content type, these assets significantly influence purchasing decisions.

3. Medical Devices & Healthcare Tech

Companies like Edwards Lifesciences, Medtronic, Siemens Healthineers, and Boston Scientific are leading the way in advancing medical devices and healthcare technology. Medical devices, such as diagnostic tools and surgical instruments, are vital in helping healthcare professionals deliver effective treatment.

These devices form a core part of the broader healthcare technology sector, covering medicines, vaccines, procedures, and digital health systems. While medical devices are essential to clinical practice, health technology as a whole aims to improve patient outcomes and enhance the quality of life across the entire care journey.

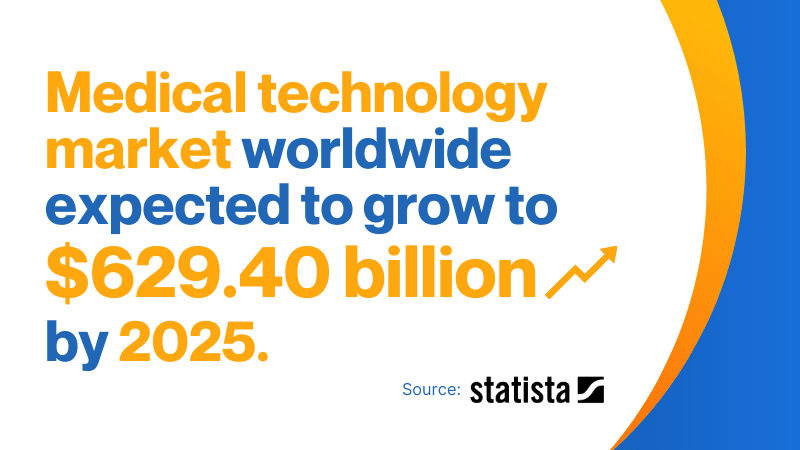

According to reports, the global medical devices market is projected to reach $671.49 billion by 2027. On the other hand, the medical technology market worldwide is expected to grow to $629.40 billion by 2025.

This growth shows a rising demand for better healthcare solutions and a bigger role for major brands in improving medical care. As new technologies emerge, more healthcare systems are investing in and using these innovations.

Statistics:

- The global medical devices market will reach $671.49 billion by 2027.

- Worldwide, the medical technology market is expected to hit $629.40 billion by 2025.

This growth reflects rising demand for innovative solutions from top brands and their increasing role in modern healthcare.

Challenges in the Medical Device Industry:

- Strict regulatory compliance

Medical device companies must meet rigorous standards set by global regulatory bodies. In the United States, the FDA requires clinical trials and specific approvals like PMA for high-risk devices and 510(k) clearance for lower-risk ones. In Australia, the TGA enforces safety and quality through a risk-based classification system and Good Manufacturing Practice standards.

In the European Union, CE Marking ensures compliance with Medical Device Regulation and ISO 13485 quality standards. These frameworks ensure product safety but also make market entry complex and time-consuming.

- Complex decision-making with multiple stakeholders

Buying medical devices involves several decision-makers, including procurement officers, clinical engineers, healthcare providers, and compliance teams. Each group prioritizes different factors, such as safety, cost, efficacy, and long-term value.

A study showed that cost was considered in all cases, followed by safety (91%), efficacy (82%), cost-effectiveness (64%), and budget impact (36%). Aligning these perspectives requires strong collaboration and communication across departments.

- High demand for clinical evidence

Before purchase, buyers require solid proof that a device is safe, effective, and worth the investment. Clinical trials play a key role in this process but can cost between $1-2 million (Phase I), $7-20 million (Phase II), and $ 20- 100+ million (Phase 3), depending on the therapeutic area:

Phase I: Tests safety & dosage

Phase II: Evaluate the effectiveness

Phase III: Compare with standard treatments

Phase IV: Monitor long-term effects post-approval

These trials test safety, effectiveness, and comparisons with standard treatments, with post-approval monitoring in Phase IV. This heavy investment is a major barrier for companies entering the market.

Lead Generation Strategies

- Key Opinion Leader (KOL) Marketing to Build Trust with Medical Professionals: Partnering with respected medical experts strengthens product credibility. KOL endorsements are up to 50x more influential in driving purchase decisions.

- Gated Content and Whitepapers on Compliance and Innovation: Detailed resources on regulatory topics and breakthroughs attract qualified leads. High-performing landing pages convert at rates between 5% and 11%.

- Email and LinkedIn Outreach to Hospital and Procurement Teams: Targeted messaging to hospital admins and procurement leads sees strong results. Email open rates in healthcare average 37%, while LinkedIn response rates reach up to 30%.

- Webinars and Live Demos Highlighting Product Benefits: Interactive sessions show how devices perform and the value they bring to healthcare. In 2024, healthcare webinars had an average attendance rate of 48%, indicating high audience interest and engagement.

4. Industrial Automation & Smart Factories

Automation in manufacturing uses machines and technology to perform tasks without human input. The goals are to enhance efficiency, productivity, and accuracy while reducing manual labor and human error.

Industrial automation, like global players Rockwell Automation, Siemens, involves using robots, CNC machines, and control systems to execute specific tasks independently. While effective, this approach focuses on individual processes. A smart factory builds on this by integrating automation with Artificial Intelligence (AI), the Internet of Things (IoT), and real-time data. The result is a fully connected and adaptive environment where the entire production system is optimized.

In a smart factory, machines and systems are interconnected, constantly generating real-time data that improves end-to-end processes. This data supports better decision-making across all levels—from operators and engineers to supervisors and executives. Smart equipment can also monitor its condition, enabling predictive maintenance to prevent breakdowns and reduce downtime.

Unlike traditional industrial automation, which operates in silos, the smart factory is dynamic, self-optimizing, and designed for continuous improvement across the entire manufacturing workflow.

The Smart Factory and Industrial Automation market is projected to attain a value of $233.5 billion by 2030, with a 3.3% CAGR from 2024. Asia Pacific currently holds a dominant position in this market, possessing over 45.5% of the market share as of 2024. Additionally, nearly 33% of investments are aimed at process automation to improve production efficiency.

Challenges:

- Engaging with Technical Audiences: Selling automation solutions to engineers, plant managers, and IT teams requires a deep understanding of technical details and the ability to communicate complex concepts clearly. Since 95% of engineers validate their online research with input from sales reps, professionals need to bridge the gap between technical specifications and real-world benefits, ensuring their message resonates effectively with these key decision-makers.

- High Upfront Costs and Long Adoption Cycles: Adopting automation technologies often involves significant capital investment and extended integration periods. To address this, the Robotics-as-a-Service (RaaS) model offers a more flexible and cost-effective alternative. Valued at USD 1.8 billion in 2024, the RaaS market is expected to grow to USD 4.0 billion by 2028, with a Compound Annual Growth Rate (CAGR) of 17.4%. This growth highlights the increasing preference for scalable automation solutions that reduce the need for large initial capital outlays.

- Standing Out in a Competitive Market: As IoT, AI, and robotics become standard in the industry, companies must continuously innovate to differentiate their offerings. The global industrial automation market, projected to reach USD 414.48 billion by 2030, is growing at a CAGR of 10.0% from 2022 to 2030. In this highly competitive environment, companies must find new ways to stand out and offer unique value to their customers.

Effective Strategies for Reaching Industrial Automation Buyers

- SEO and Educational Content for Inbound Leads: Creating detailed, search-optimized content directly addressing automation engineers’ needs can significantly boost visibility and lead generation. By addressing technical challenges and offering expert insights, your brand becomes a trusted source. With SEO leads showing an average close rate of 14.6%—compared to just 1.7% for outbound efforts—this strategy is both efficient and impactful.

- LinkedIn Outreach and ABM for Key Decision-Makers: Targeted LinkedIn prospecting and ABM are effective for engaging factory managers, supply chain heads, and CIOs. With 97% of marketers reporting higher ROI from ABM than other methods, focusing on personalized engagement across high-value accounts can strengthen relationships and improve conversion rates.

- Video Marketing to Demonstrate Product Value: Videos, especially short-form ones under 90 seconds, are powerful tools for showcasing automation solutions in action. These formats hold a 50% viewer retention rate and help prospects quickly understand product capabilities. With 32% of businesses using video for product demos, it’s a proven way to highlight features and build interest.

- Trade Shows for High-Quality Lead Generation: Participating in major events like Automate, Hannover Messe, and Smart Factory Expo offers direct access to a highly relevant audience. Hannover Messe 2025, for example, is set to host over 4,000 exhibitors and 300 startups, making it a prime venue to connect with industry leaders, demonstrate solutions, and generate quality leads on-site.

5. Robotics & Automation in Manufacturing

Manufacturing robotics and automation are central to modern production. They allow factories to increase output, improve consistency, and reduce manual labor. By combining robotics with machine vision and advanced control systems, manufacturers can carry out complex and repetitive tasks with high precision and efficiency.

Industry leaders such as Fanuc, Yaskawa, KUKA, Universal Robots, Boston Dynamics provide various solutions tailored to different manufacturing needs. These include articulated robotic arms for pick-and-place operations, mobile robots for material transport, and autonomous systems for real-time inspection. Their systems are built for reliability in high-speed, high-volume production environments.

Automation is changing not only how products are made but also job structures and business models. At least 30% of tasks in 60% of all occupations can be automated. Automation could increase global productivity by 1.5% annually, showing its strong economic impact.

There are several ways automatic manufacturing is adopted by B2B business. Some begin with a single robot, while others invest in fully automated lines. Robots with three or six axes are often programmed to perform the same task precisely, while more advanced systems offer flexibility to handle different tasks as needed.

Automation is not just about replacing workers but about building smarter, more efficient operations. As robotics continues to reshape manufacturing, the advantage will come from how effectively companies deploy and integrate these technologies into their operations.

Challenges:

- High Upfront Costs Require Clear ROI Justification: Automation systems often involve a large initial investment in equipment, software, integration, and training. Ongoing maintenance and compliance training add to the total cost. To justify this, companies must calculate long-term returns by comparing net benefits against total investment. ROI models should include cost savings, productivity gains, and operational improvements.

- Lack of Understanding about Efficiency Gains: Many finance and management teams aren’t fully aware of how robotics improves workflow. Automation cuts waste, increases output, and scales operations more efficiently. Go for resources that offer real-world examples and simplified content that help decision-makers understand the true impact of automation.

- Multiple Stakeholders Complicate Buying Decisions: Purchasing decisions often involve engineers, finance teams, and plant managers—each with different priorities. While engineers look at technical fit, finance focuses on costs, and plant managers want operational improvements. Misalignment can delay decisions. A clear business case that addresses each group’s concerns helps move the process forward.

Lead Generation Strategies

- Targeted Outreach via Email and LinkedIn

Reach out to factory automation specialists using data-driven campaigns. Personalize content based on industry, job role, and behavior to improve response rates and start meaningful conversations. - Use Gated Content to Educate and Convert

Offer ROI calculators, case studies, and industry reports behind a lead form. This educates prospects while generating qualified leads. Make sure the content is relevant and useful for best results. - Retargeting and Paid Ads for High-Intent Leads

Use retargeting to stay in front of website visitors interested in robotics. Pair this with paid ads, such as PPC, to reach buyers actively searching for automation solutions. These tools help maintain visibility and drive conversions. - Webinars and Virtual Demos for Product Education

Host webinars and live demos to show how your automation solutions work in real scenarios. These events build credibility, answer questions, and allow prospects to engage directly with your team.

Related Reading: How to Market your RPA Software and Get More Sales

6. Aerospace & Defense Manufacturing

The aerospace and defense (A&D) sector is central to national security, commercial aviation, and technological innovation. It involves the design, production, and lifecycle management of aircraft, spacecraft, missiles, and defense systems used in both government and commercial applications. The industry is highly regulated, requiring strict compliance with safety, quality, and security standards.

Leading global companies such as Lockheed Martin, Boeing, Raytheon, BAE Systems, Northrop Grumman are at the forefront of this sector. These organizations drive advancements in next-generation aircraft, autonomous systems, missile defense, and space technologies. Their work spans both domestic and international defense programs and plays a key role in strategic global alliances.

The core of the A&D industry includes manufacturing military and commercial aircraft, guided missiles, space vehicles, ammunition, and armored vehicles, along with all supporting systems and technologies. Surrounding this are critical supply chain sectors such as advanced materials, electronics, software, composites, and engineering services.

Recent developments have pushed aerospace and defense into the spotlight. Breakthroughs in clean propulsion, space exploration, and autonomous flight have sparked market interest.

At the same time, increased defense spending due to global conflicts and rising geopolitical tensions continues to fuel demand for sophisticated military systems. However, the industry also faces scrutiny from equipment malfunctions and cyber vulnerabilities, underscoring the need for ongoing innovation and resilience.

Market data reflects the sector’s robust growth trajectory. Globally, the aerospace and defense market is projected to expand from $820.67 billion in 2024 to $875.37 billion in 2025, reflecting a 6.7% CAGR. In APAC, the military aviation market alone is expected to grow from $13.23 billion in 2025 to $19.31 billion by 2030, with a CAGR of 7.85%. These figures indicate a strong investment outlook and a growing strategic footprint for defense and aerospace capabilities worldwide.

Challenges in Aerospace and Defense Manufacturing

- Complex Compliance and Lengthy Approvals: Aerospace and defense manufacturing requires careful navigation of strict regulatory standards such as AS9100, ITAR, and FAA requirements. These frameworks demand extensive documentation and process control, contributing to long approval cycles and high operational overhead. With over 24,000 AS9100 certifications worldwide, many companies rely on specialized manufacturing execution systems (MES) to automate quality checks, track non-conformances in real time, and maintain audit-ready records.

- Narrow Market Focus: The industry’s customer base is limited to government agencies, defense contractors, and select private aviation firms. This concentrated market results in revenue volatility and heightened competition. Long sales cycles, coupled with heavy reliance on defense contracts, make diversification difficult and increase the importance of compliance-driven strategic planning.

- High Security and Confidentiality Demands: B2B transactions in this sector must meet rigorous security standards to protect sensitive data and intellectual property. The average cost of a data breach in aerospace and defense is estimated at $5.46 million, highlighting the need for strong cybersecurity protocols, including encryption, role-based access, and regulatory compliance.

Lead Generation Strategies:

- Account-Based Marketing (ABM) for Government and Procurement Stakeholders

ABM is a powerful approach for targeting defense agencies and procurement officers responsible for RFPs. By aligning marketing and sales efforts toward specific high-value accounts, ABM helps navigate A&D’s long procurement cycles. According to industry data, 76% of marketers report higher ROI with ABM compared to other strategies. Its personalized nature leads to stronger engagement, better alignment, and increased contract wins in government-focused sales environments. - Whitepapers and Gated Reports on Aerospace Innovation and Compliance

Sharing valuable resources such as whitepapers and gated industry reports strengthens thought leadership and drives top-of-funnel interest. A&D buyers are highly research-driven—90% of B2B buyers review multiple sources, and most engage with 3 to 7 content pieces before initiating contact with sales. In a sector where technical expertise is crucial, detailed reports on compliance trends, safety standards, and technology breakthroughs help inform prospects and accelerate conversion.

- LinkedIn Outreach to Aerospace and Defense Decision-Makers

LinkedIn continues to be one of the most effective platforms for reaching key contacts in aerospace and defense. Professionals in this sector are 25% more likely to respond to direct outreach than those in other industries. By using personalized messages and connecting with targeted decision-makers—such as engineering leads, procurement heads, and program managers—companies can build relationships that lead to high-value contracts. - Trade Shows and Industry Networking Events

Participating in major aerospace and defense exhibitions creates strong opportunities for brand exposure and relationship building. Events like the Farnborough Airshow and the Defense & Security Expo gather global stakeholders, including military buyers and aerospace suppliers. The Singapore Airshow 2024 welcomed nearly 60,000 trade visitors, representing a 10% increase from 2018 and reflecting growing interest and investment in the region. These venues are ideal for showcasing capabilities, gathering competitive intelligence, and forming new partnerships.

7. Sustainable & Low-Carbon Manufacturing

Sustainable manufacturing has moved from a corporate initiative to a competitive requirement. Companies such as Tesla, ABB, Siemens Energy are reengineering their production environments to lower carbon output, improve resource management, and reduce energy waste.

This transformation is not limited to installing greener technologies. It involves fully reassessing the value chain, from raw material sourcing and factory operations to logistics and product end-of-life planning. Steel, aluminum, cement, and chemical manufacturing currently account for 17 to 22% of global greenhouse gas emissions, underscoring the urgency for change across heavy industries.

The sustainable manufacturing market, valued at $193.74 billion in 2023, is projected to reach $491.99 billion by 2032, growing at a CAGR of 10.9%. This growth reflects a global push for cleaner production models, driven in part by rising carbon pricing and stricter compliance requirements. Already, 70% of global manufacturers have committed to net-zero emissions targets by 2050, signaling a long-term shift in industrial strategy.

Organizations that embed sustainability into their core operations see tangible benefits in efficiency, cost control, and regulatory alignment. Early adopters are not only avoiding penalties but also strengthening their competitive edge in an increasingly carbon-conscious market.

Challenges in Selling Sustainability Solutions

- Long ROI Expectations from Green-Focused Buyers

Selling to environmentally-conscious businesses often comes with long return-on-investment timelines. 41% of executives report taht their companies underperform or remain uncertain when evaluating the ROI of sustainability initiatives. To close deals, vendors must provide clear, data-backed financial value. - Low Market Awareness of Sustainability’s Business Impact

Many companies struggle to connect sustainability with cost efficiency and risk reduction. Only 2% of Fortune 500 board members have the green skills required to address sustainability risks, highlighting a major knowledge gap. Effective education and training are needed to shift this mindset. - Complex and Evolving Compliance Landscape

With over 2,000 climate laws in place globally, navigating regulations is a major challenge. In the Asia-Pacific region, 80% of businesses struggle to keep up with ESG compliance standards. Adherence is critical for reducing legal risks and maintaining transparency.

Lead Generation Strategies for Sustainability-Focused Offers

- Content Marketing with ESG Case Studies

Content marketing generates over 3x more leads than outbound marketing and costs 62% less. Sharing real-world ESG and sustainability success stories builds trust and credibility while attracting decision-makers. - Account-Based Marketing for Green Tech and Sustainability Teams

ABM allows tailored campaigns aimed at specific targets. Focusing on green-tech companies and corporate sustainability teams increases engagement and boosts conversion rates. - Webinars Featuring Net-Zero Experts

Webinars are highly effective, with 51% of B2B marketers ranking them as the top-performing video format. Hosting expert-led sessions around net-zero goals educates and nurtures qualified leads.

Webinars and live demos are powerful, but only when the right people show up. Let us help you fill your next event with qualified leads from our database of manufacturing decision-makers. Talk to us about our Event Lead Generation services. - LinkedIn Ads and Lead Nurturing for Eco-Minded Buyers

LinkedIn drives strong B2B results—used by 89% of marketers for lead gen, with 62% saying it outperforms other social platforms. Ads and nurturing sequences focused on sustainability topics effectively engage eco-conscious prospects.

8. Military-Grade Manufacturing

Prominent defense manufacturers such as BAE Systems, General Dynamics, Rheinmetall, Lockheed Martin, and Raytheon Technologies operate under some of the most rigorous production standards globally. These standards are governed by specifications set by the U.S. Department of Defense (DoD), ensuring that all components meet strict requirements for reliability, resilience, and performance in extreme environments.

Products classified as MIL-SPEC or MIL-STD are designed, built, and tested to meet stringent military specifications—often exceeding those of commercial-grade counterparts. These standards cover everything from raw material sourcing and fabrication methods to quality control and supply chain compliance, resulting in products that offer greater durability and operational reliability.

Although the terms MIL-SPEC and MIL-STD are often used interchangeably, they each refer to formal sets of requirements established by the DoD. In contrast, the label “military grade” is largely a marketing term and does not guarantee compliance with official military standards.

Demand for certified military-grade products continues to rise. The military-grade cases market is valued at USD 390.3 million in 2024, with projections reaching USD 552.1 million by 2034, reflecting a 3.5% CAGR. In 2023, the market recorded USD 371.7 million in revenue, demonstrating steady growth across defense sectors.

Defense firms are seeing this demand reflected in financial performance. BAE Systems reported £26.3 billion in revenue for 2024, a 14% increase from 2023, supported by its focus on combat systems, naval assets, and cybersecurity. Meanwhile, Japan’s Mitsubishi Heavy Industries (MHI) experienced a 26% stock increase following policy shifts that enabled greater military exports to Europe.

As defense requirements tighten and global demand intensifies, MIL-SPEC compliance is becoming a strategic advantage for manufacturers, setting a higher bar for quality, performance, and long-term value in military-grade equipment.

Challenges in Military-Grade Manufacturing and How to Overcome Them

- Security Clearance Requirements: To work on defense contracts, both companies and their staff need proper security clearances. This ensures that only trusted individuals handle sensitive information. The clearance process is detailed and often takes 9–12 months, including:

- Conditional Job Offer – Clearance starts only after a job offer is made.

- SF-86 Form – Personal, employment, and background info must be submitted.

- Polygraph Test – Required by some agencies, focusing on national security issues.

- Psychological/Medical Evaluation – This may be included depending on the role.

- Credit & Background Check – Includes a National Agency Check (NAC).

- Field Investigation – Verifies past employment, education, and personal references.

- Final Review – Once approved, the final job offer is made.

- Long Approval and RFP Cycles: Military contracts often involve extended approval periods. The Request for Proposal (RFP) process includes strict documentation, multiple levels of evaluation, and compliance checks. It can take several months before any decision is made. Factors like federal budget approvals and political reviews can delay this further.

- Complex Procurement Rule: Defense contractors must follow federal procurement policies like FAR and DFARS. These govern everything from sourcing and cybersecurity to business ethics. Non-compliance can lead to disqualification, fines, or even legal consequences.

Lead Generation Strategies That Work

- Account-Based Marketing (ABM) for Government: Target specific procurement officers and agencies using personalized messaging that focuses on compliance, past success, and mission relevance. Highlighting certifications and track records builds trust.

- Case Studies That Prove Capability: Use detailed case studies to show how your company has delivered results while meeting military standards. For example, A2B Tracking saw a lead surge by branding its products as “military grade.”

- LinkedIn Prospecting and Industry Networking: Build connections with defense professionals on LinkedIn and attend defense expos. Being active in forums and trade events builds visibility and trust. Platforms like Military Systems & Technology are great for networking.

- Content Marketing on Military Technologies: Publish educational content on military-grade materials, standards, and innovations. Articles, white papers, and reports help attract informed buyers and position your brand as an expert in the field.

Boost Your Advanced Manufacturing Sales with Callbox

As AI revolutionizes production in advanced manufacturing, the pressure to stay ahead of competitors grows. To succeed, companies must move away from generic lead generation methods and focus on highly specialized approaches that target the right prospects. In a rapidly shifting market, precision is key to maintaining a competitive advantage. Here’s where Callbox can help.

Since 2004, Callbox has specialized in B2B lead generation for manufacturing businesses, helping them build reliable, high-quality sales pipelines. Our multi-touch, multi-channel approach focuses on valuable prospects and guides you through a tailored sales process for optimal results.

Partner with Callbox to streamline your lead generation and achieve the success you need to excel in a rapidly changing market. Let’s turn your opportunities into results.